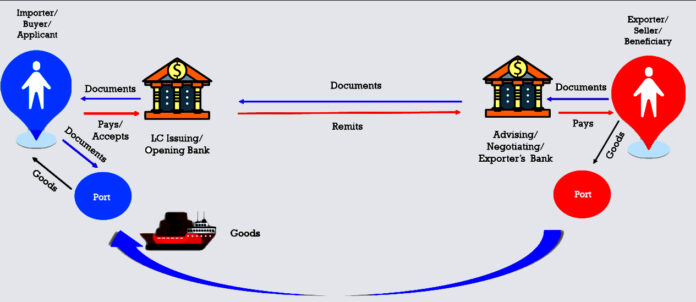

1. Selecting the Appropriate Bank

✅ Selecting a bank with a solid experience in global & international trade to guarantee seamless transactions.

✅ Compare the LC terms, fees, and processing times with the various banks.

✅ To lower the risk when working with unfamiliar foreign banks, think about the using a confirming bank.

2. Lower Charges & Fees of an LC

🚀 Advice for Bargaining:

- Looking into rates from various banks and taking the advantage of competition to bargain for reducing the costs as lower.

- If you are a regular customer, then ask for a discount on processing the fees.

- Request them to have the amendment fees waived or reduced for small modifications to the document.

- To cut off the expenses & choose a standby LC if you conduct transactions at every moment.

3. Improving the LC Terms & Conditions of Payment

🚀 Advice for Bargaining:

- To guarantee the stability and the security, choose an irrevocable LC.

- To prevent last-minute changes & ask for an elaborate validity period.

- To improve the cash flow and delay payments, if you are the buyer then request a Usance LC (Deferred Payment LC).

- For an immediate payment, if you are the seller then ask for a sight LC.

4. Lower Document Complexity & Risks

🚀 Advice for Bargaining:

- Reduce the complexity of document requirements to prevent irrelevance that might cause the delay payment.

- To avoid the needless rejections, steer clear of ambiguous terms like “any other documents required by the bank.”

- To stop misunderstandings, make sure that all terms keep to accepted business practices.

5. Safe Exchange Terms & Favorable Currency

🚀 Advice for Bargaining:

- Secure aIf working with volatile currencies, verify the exchange rate with the bank.

- To prevent fluctuations, request for the option to settle in a permanent currency such as USD or EUR.

- For an LC transaction, bargain for a reduced currency transformation margin.

6. Enhance the LC Verification & Promises

🚀 Advice for Bargaining:

- For extra security, get the LC confirmation from a second bank if you are working with a risky buyer.

- If you have strong credit then ask for a reduced confirmation fee.

- In the event that your primary LC becomes disputed or delayed, use a instrumental LC as a backup.

7. To Establish a Strong Bonding with the Bank

🚀 Advice for Bargaining:

- To achieve better terms, keep your business history and credit score strong.

- To receive the loyalty discounts, we should use other banking services such as trade loans and forex services.

- Have numerous conversations to be informed of any new offers, contact your business finance manager.

In conclusion

In a strong banking relationship, financial strength, and market research are all necessary for negotiating better LC terms. Businesses can cut expenses, enhance cash flow, and lower trade risks by streamlining fees, terms of payment, and documentation requirements.