Incoterms (International Commercial Terms) are a set of internationally recognized rules that define the responsibilities of buyers and sellers in the delivery of goods. They specify who is responsible for the cost, risk, and insurance during shipping. Incoterms are used in contracts of sale to avoid confusion about these responsibilities and ensure smooth international trade.

The Incoterms define the following key elements:

- Delivery location: Where the goods are delivered to the buyer.

- Cost allocation: Who is responsible for which costs (e.g., shipping, insurance, customs duties).

- Risk transfer: The point at which the responsibility for the goods shifts from the seller to the buyer.

Let’s dive into the three common Incoterms: EXW, FOB, and CIF.

1. EXW (Ex Works)

Definition: The seller delivers the goods at their premises or another agreed location (factory, warehouse, etc.). The buyer is responsible for all costs and risks involved in transporting the goods from the seller’s premises to their destination.

Seller’s Responsibilities:

- Make goods available at their location.

- Provide the buyer with necessary documents (e.g., commercial invoice, packing list).

Buyer’s Responsibilities:

- All transportation costs (including domestic and international shipping).

- Export customs clearance and duties.

- Insurance.

- Risk: The risk transfers to the buyer once the goods are made available for pickup.

When to use EXW:

- When the seller wants to minimize responsibility, and the buyer has the capacity to handle the shipping and customs clearance processes.

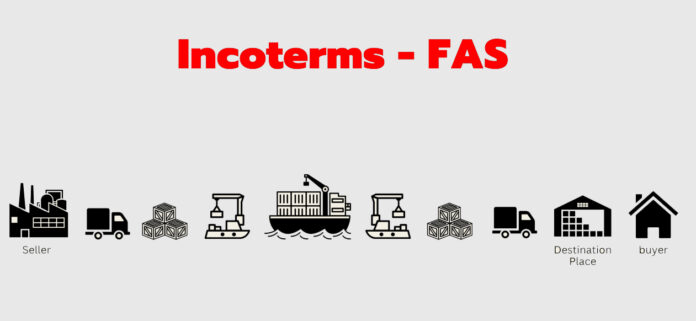

2. FOB (Free On Board)

Definition: The seller is responsible for delivering the goods onto the ship at the designated port of shipment. Once the goods are loaded onto the vessel, the risk and responsibility for the goods shift to the buyer.

Seller’s Responsibilities:

- Transport of products to the port of shipment.

- Handle export customs clearance and pay any export duties.

- Load the goods onto the ship.

Buyer’s Responsibilities:

- Freight costs from the port of shipment to the destination.

- Insurance for the goods during transit.

- Import customs clearance and duties at the destination port.

- Risk: The risk transfers once the goods are loaded onto the vessel at the seller’s port.

When to use FOB:

- When the buyer wants control over the freight and is familiar with the port at the destination but is still willing to share some responsibility for the shipping costs.

3. CIF (Cost, Insurance, and Freight)

Definition: The seller is responsible for delivering the goods to the port of destination, covering the cost of transportation and insurance to the buyer’s designated port. However, the risk transfers to the buyer once the goods are loaded onto the ship at the port of departure.

Seller’s Responsibilities:

- Pay for the shipping cost and insurance to cover the goods during transit to the port of destination.

- Handle export customs clearance and pay any export duties.

- Provide the buyer with documents required to claim the goods, like the Bill of Lading and insurance certificate.

Buyer’s Responsibilities:

- Pay import duties and customs clearance fees at the destination port.

- Risk: Risk transfers to the buyer once the goods are loaded onto the vessel at the port of shipment, but the seller is responsible for the insurance during the transit.

When to use CIF:

- When the buyer wants the seller to handle the shipping and insurance up to the destination port but is still responsible for customs clearance and inland delivery.

Summary of Differences

| Incoterm | Seller’s Responsibility | Buyer’s Responsibility | Risk Transfer |

| EXW | Goods made available at seller’s location | All transport, customs, duties, insurance, risk | When goods are made available for pickup |

| FOB | Transport to port of shipment, export customs clearance, and loading | Freight, insurance, import duties, risk | Once goods are on board the vessel |

| CIF | Shipping costs to destination port, insurance, export customs clearance | Import duties, inland delivery, risk | When goods are loaded onto the vessel at origin port |

Key Differences to Consider:

- Cost and Risk: With EXW, the buyer assumes all costs and risks from the seller’s door, while in FOB and CIF, the seller takes on more responsibility for transport and risk up to the point of shipment.

- Control: In FOB, the buyer has more control over the shipping, whereas in CIF, the seller arranges the shipping and insurance, leaving less control for the buyer.

- Insurance: CIF includes insurance, while EXW and FOB require the buyer to arrange their own insurance if they want it.

Conclusion:

- Use EXW when the buyer has more control over the logistics process and wants to minimize the seller’s involvement.

- Use FOB when the seller handles everything until the goods are loaded onto the ship, but the buyer takes on responsibility from that point.

Use CIF when the seller is responsible for the shipping costs and insurance but the risk transfers once the goods are loaded onto the ship.